Chrissy and I review our spending on a quarterly basis. Updating every 90 days isn’t too long to correct mistakes and remember purchases, but it also allows for the busy multi-week sprints that life presents us. While we have used every financial management program available, I’ve found the most straightforward and flexible solution is to download historical transactions into Excel where I can assign categories and do the type of analysis you can see below. This works for me because I have complete control. All the other solutions I used (MS Money, Quicken, Mint, GNU Wallet) introduce errors that have required lots of time to fix (or that can’t be fixed), but more importantly they constrain me to their interface and I got used to exporting information into tools that could flexibly answer my questions.

My basic workflow is to download statements from all our bank accounts and credit cards in put them all into one spreadsheet, where I ensure a consistent list of categories. I can do this quickly by filtering and sorting as most of our expenses are cyclical. Once everything is in the right format, I use lots of Excel SUMIF and SUMIFS functions to produce reports.

My purpose of doing a financial review is intended to accomplish the following:

- Quality check (Are we getting paid the right amounts? Any incorrect expenses?)

- Spending feedback (Are we overpaying in any categories? Anything we need to reign in?)

- Tax Production

While my tax production and quality check was very helpful to me, I wanted to share the results of the spend analysis in case my reports might be useful to others.

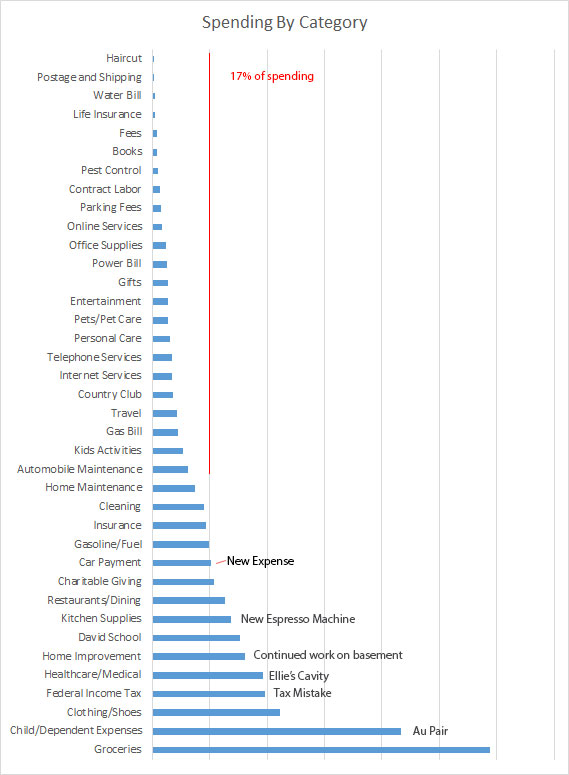

Spending feedback

In summary, we had a small rise in our overall Grocery and Dining out categories, but the major cost drivers were:

- Ellie’s 12 cavities were very expensive (no dental insurance)

- We bought a new espresso machine (major purchase for us)

- We bought a new car

- We went crazy on clothes

- Committed (again) to Army Navy Country Club

Where are we spending?

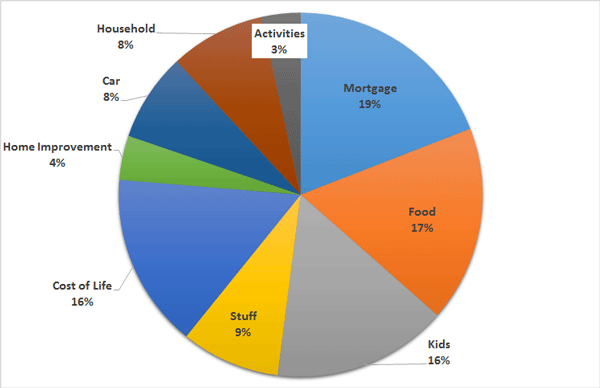

This doesn’t have a real effect on our spending, but I thought this was interesting. We don’t have saving/investments in here, this is just “spending”. I treated stuff like insurance, taxes, medical, fees, haircuts, etc as “cost of life” — things I feel we can’t avoid and don’t really have discretion in spending. Some other stuff that might fit this category (power bill) gets lumped into household (as does home maintenance and mortgage). I would love to do some more analysis and compare our spending to this article.

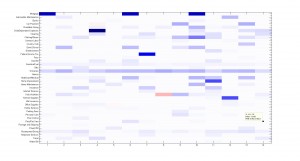

Daily Feedback

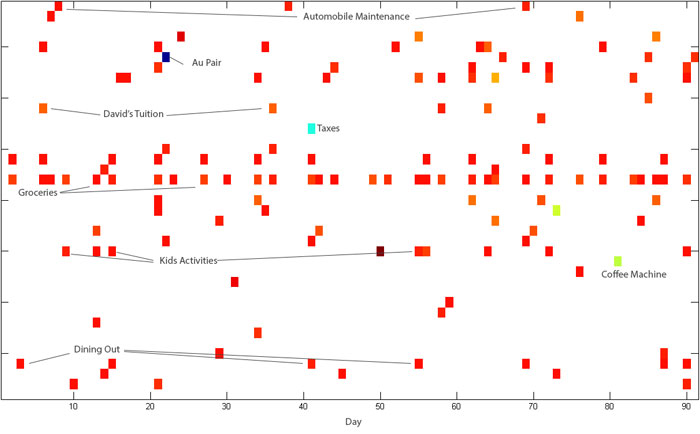

The plot below has categories on the Y-axis and days on the bottom. Intensity of color is the spend amount. I used matlab to produce this plot. I like it because the colormap used filters everything in way that comes out like a log scale — and that tells me what is a big deal and what is noise. The interesting dynamic is the frequency/magnitude trade that happens with spending dynamics: medical is in seldom/big chunks while grocery expenses are a constant but smaller expense.

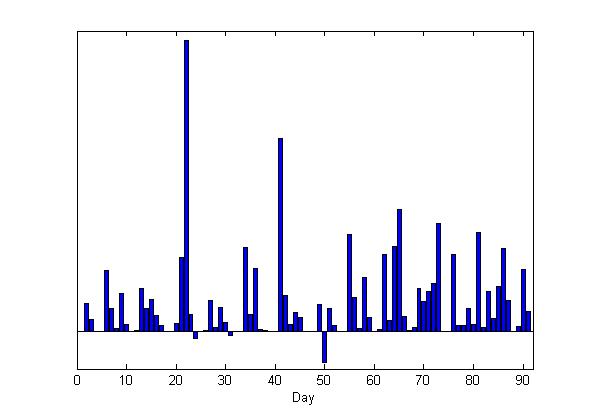

You can see that our daily spending has a huge variance: The spending had a standard deviation that was twice our average spending — big purchases had a pronounced effect. I explore four levels of spending: discretionary (dining out), some and limited discretion (haircuts, medical) and non-discretionary (mortgage, tax) at the bottom.

Weekly Feedback

Click on the below to see full size

So how much can we control this?

If I break down spending into four categories:

- Committed — We have to pay it (i.e. Mortgage)

- Limited Discretion — We can commit extra time to reduce it (i.e. Home and Car Maintenance)

- Some Discretion — We can make choices to decrease our quality of purchase (i.e. Groceries)

- Total Discretion — We can do without this if we have to (i.e. Dining Out/New Clothes)

It turns out that a third of our expenses are committed where about a quarter each apply to limited and some discretion. Roughly 20{aaa01f1184b23bc5204459599a780c2efd1a71f819cd2b338cab4b7a2f8e97d4} of our expenses are totally discretionary and 70{aaa01f1184b23bc5204459599a780c2efd1a71f819cd2b338cab4b7a2f8e97d4} of our expenses could be changed if we had to. The takeaway for me is to focus on eliminating the stuff we pay for but don’t enjoy (fees) and the things that don’t bring joy/reward for their cost.

Leave a Reply